Diamonds as an investment: what to invest in

Investment-grade diamonds possess an exceptionally rare combination of weight, clarity, colour, and cut, ensuring that demand for them remains stable or continues to grow. The higher these characteristics, the rarer the diamond, and the greater its investment appeal and potential return.

Choosing a diamond to invest in

Investment Diamonds

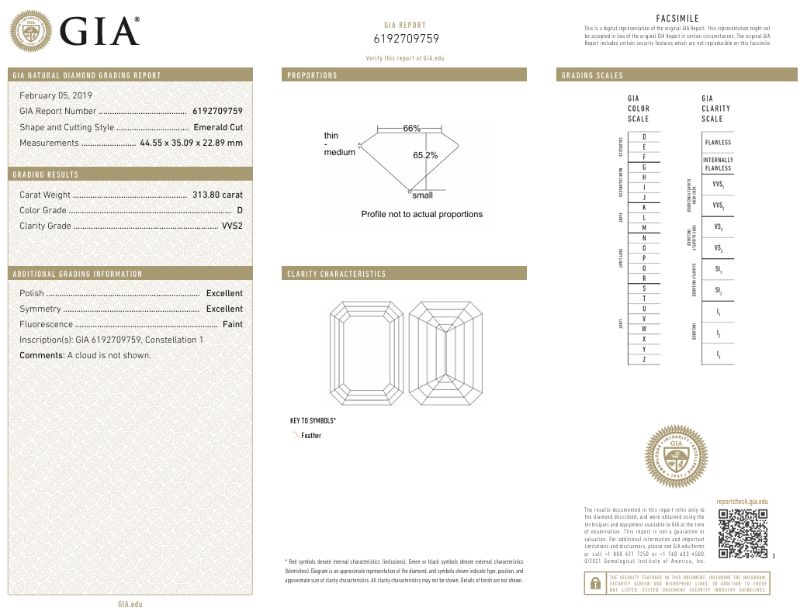

313.80 carat 6192709759

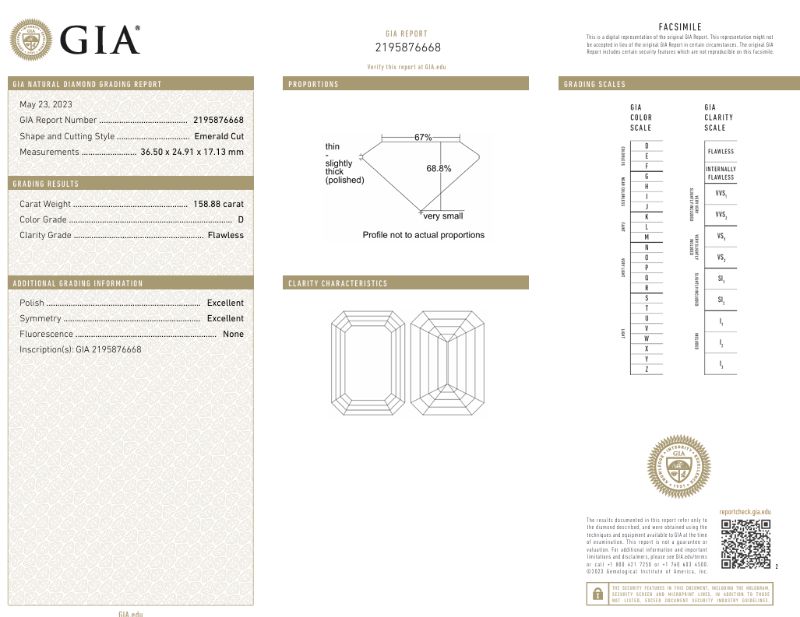

158.88 carat 2195876668

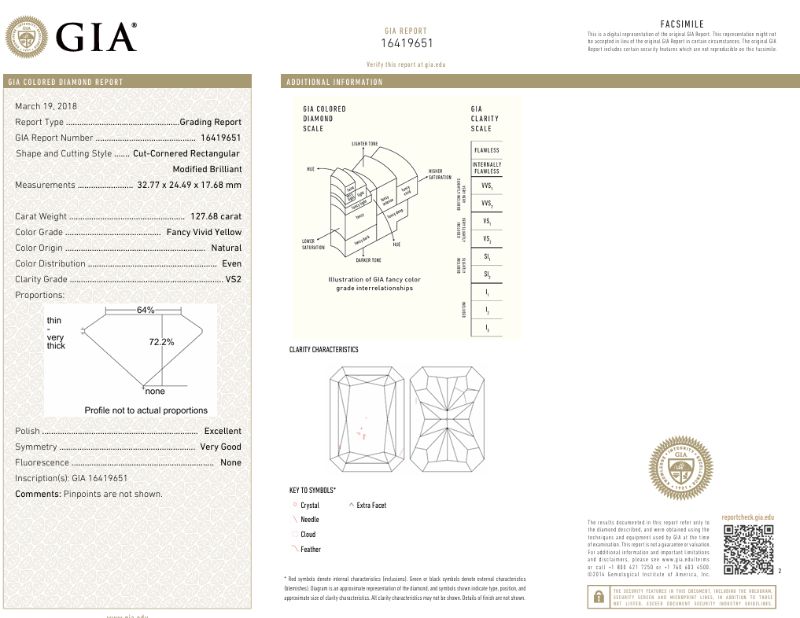

127.68 carat Fancy Vivid Yellow 16419651

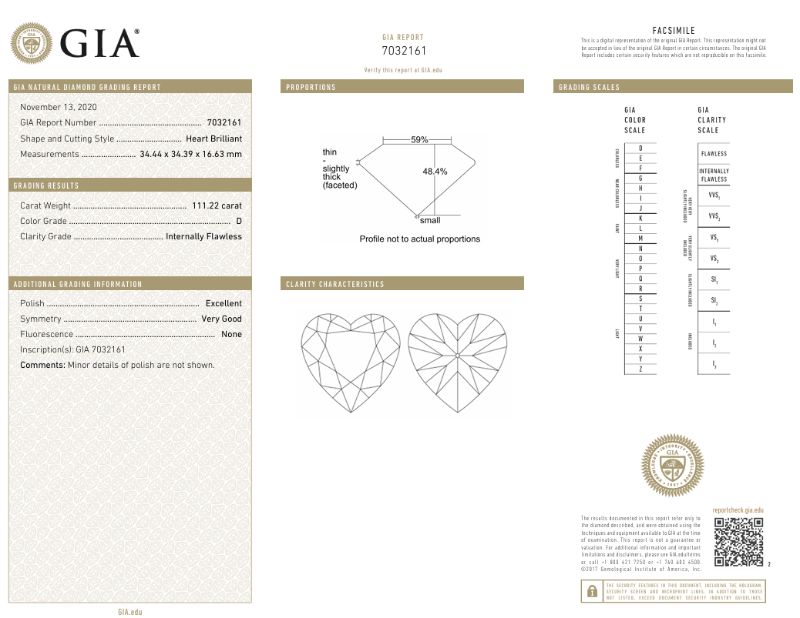

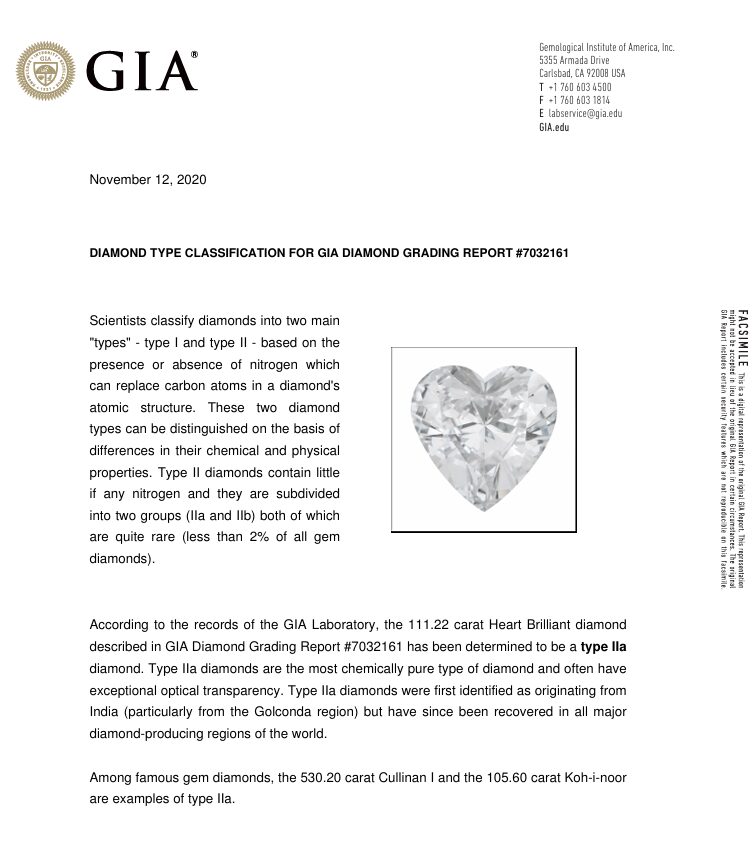

111.22 carat Heart shape 7032161

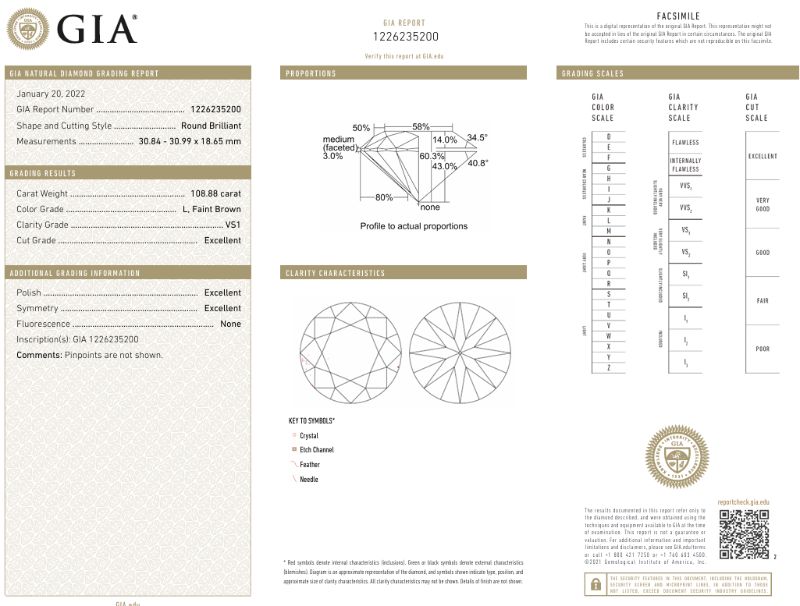

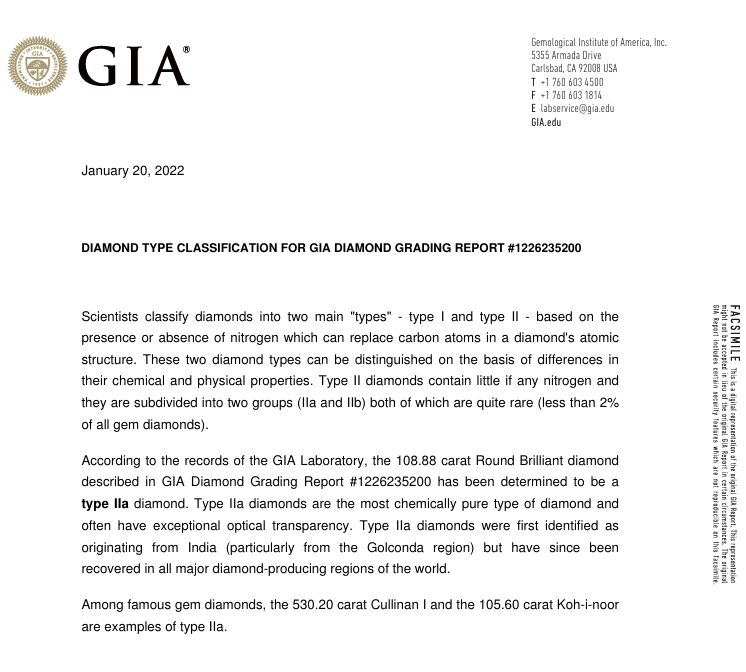

108.88 carat 1226235200

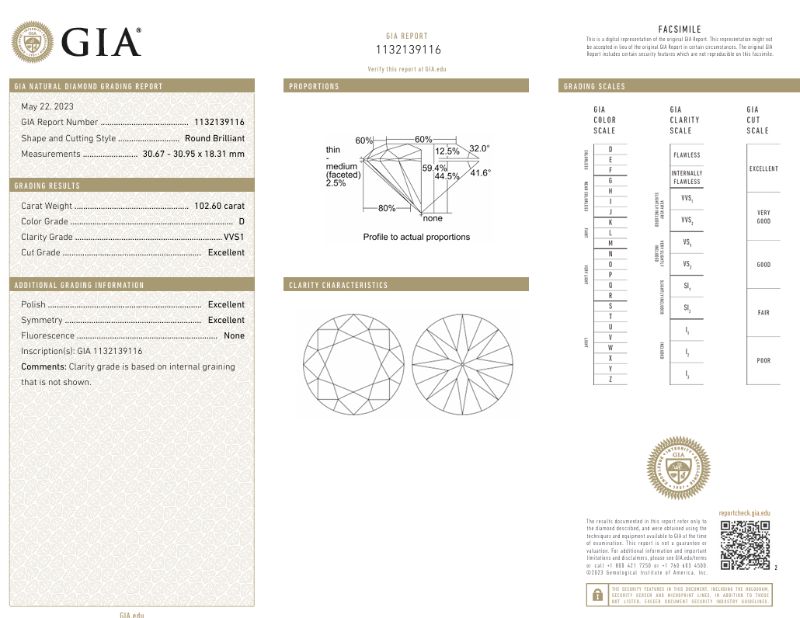

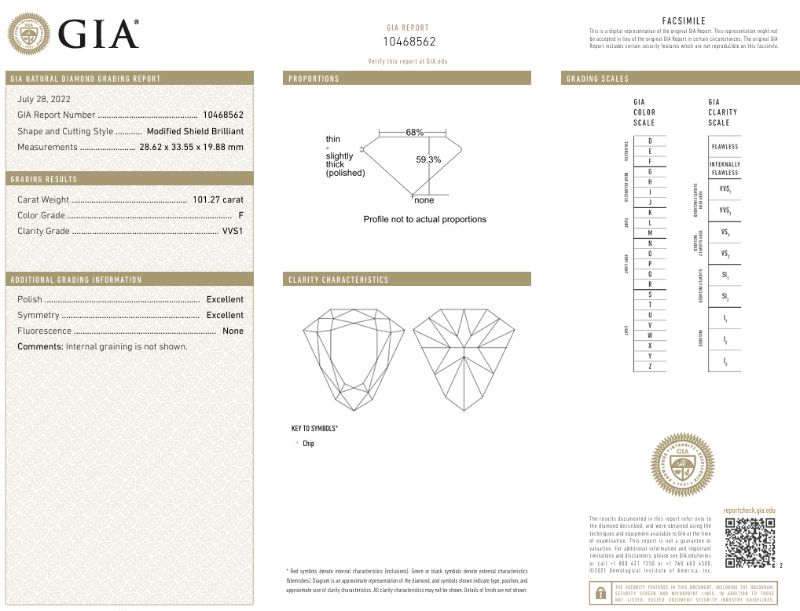

102.6 carat 1132139116

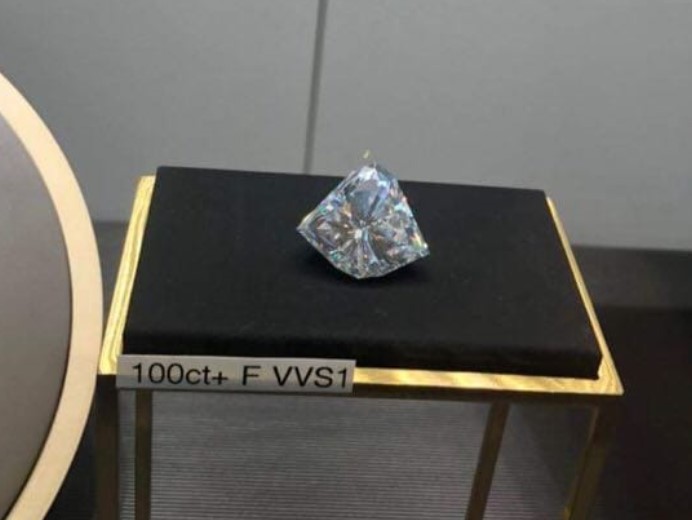

101.27 carat 10468562

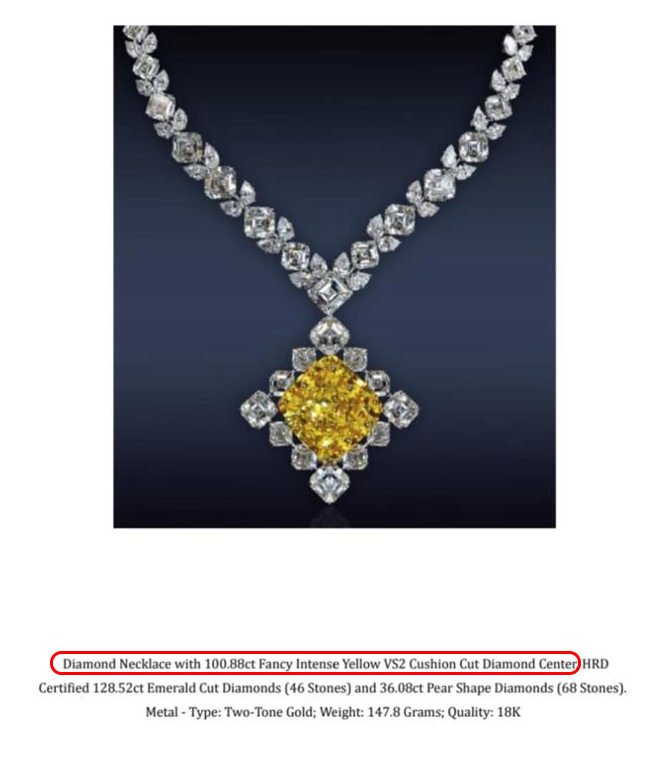

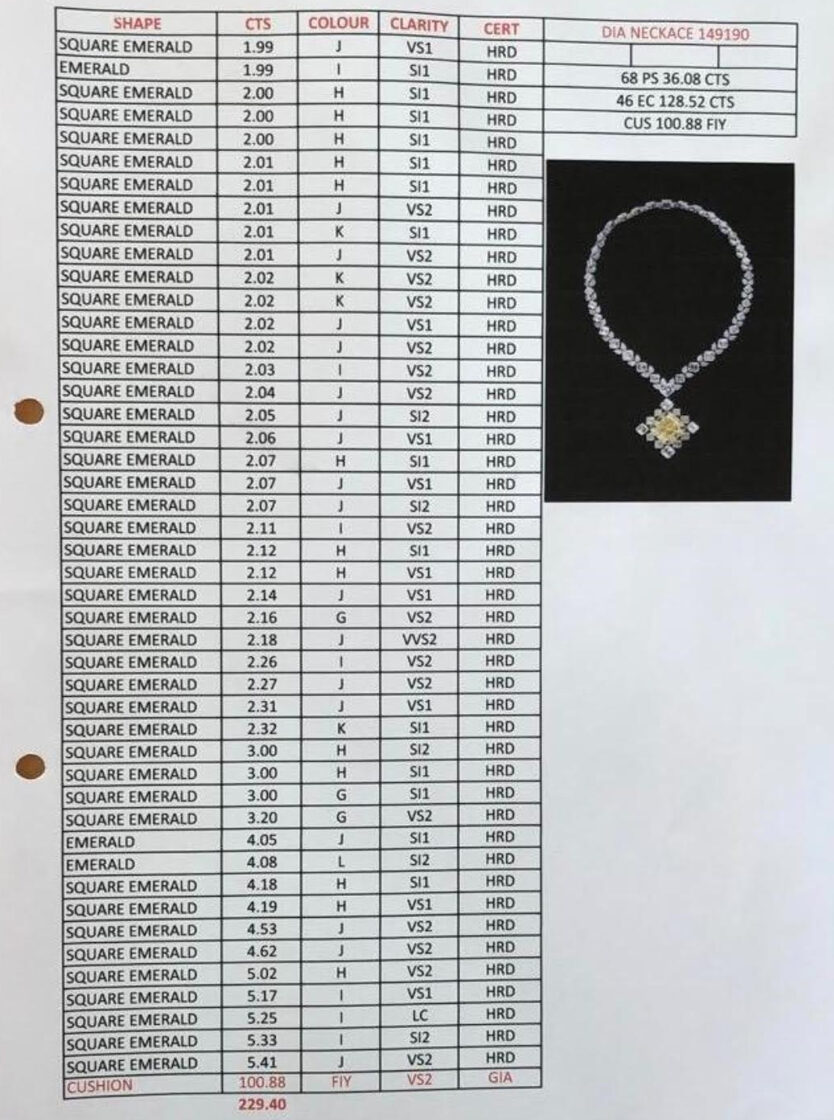

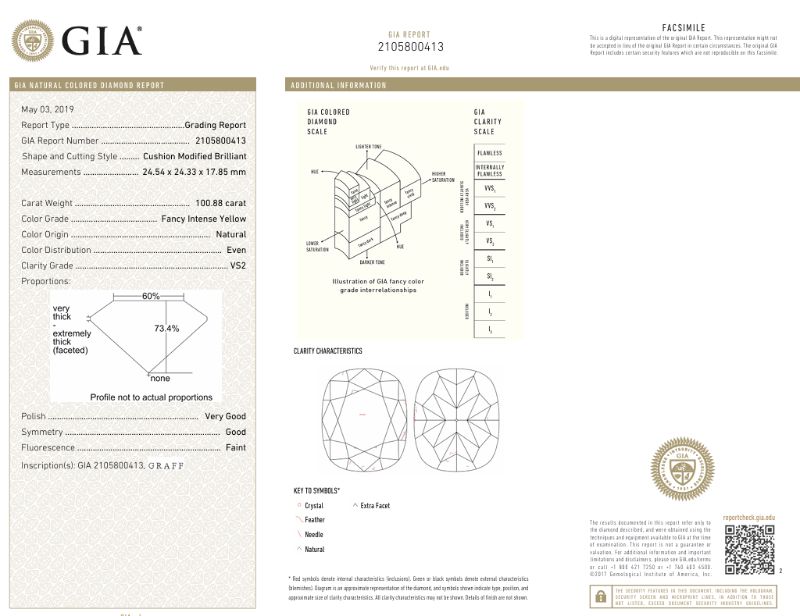

100.88 carat Yellow 2105800413

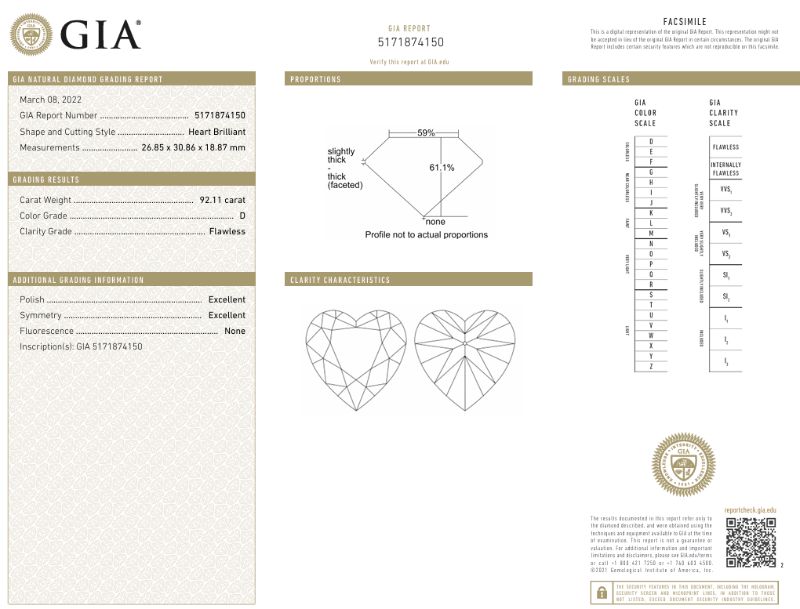

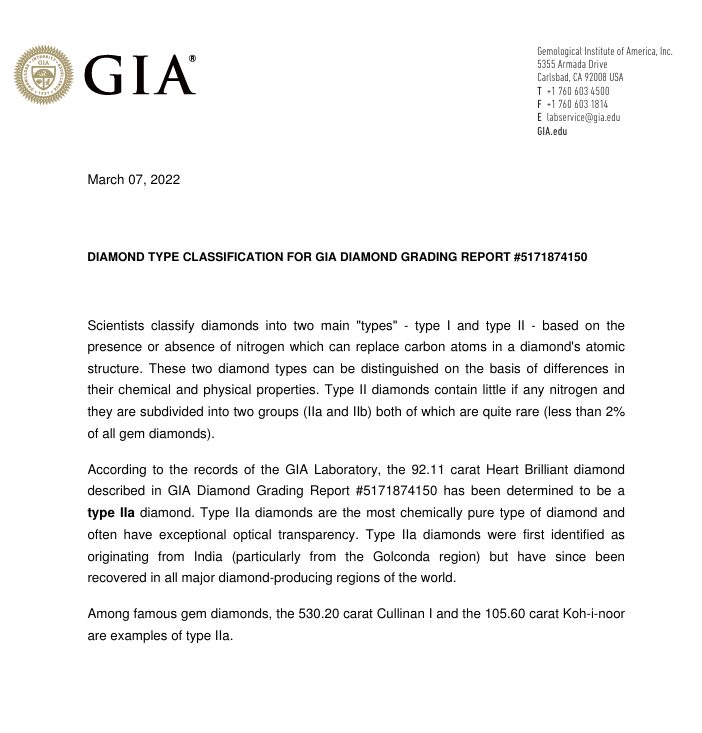

92.11 carat 5171874150

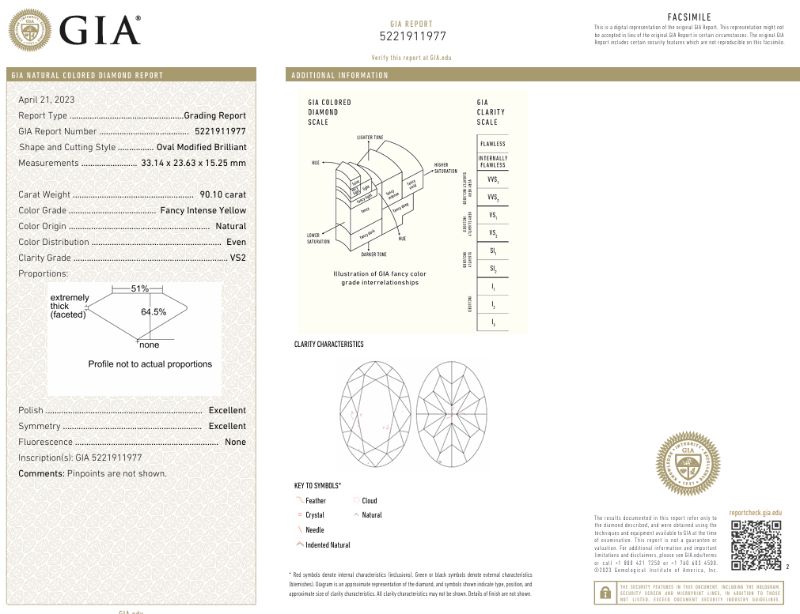

90.10 carat Yellow 5221911977

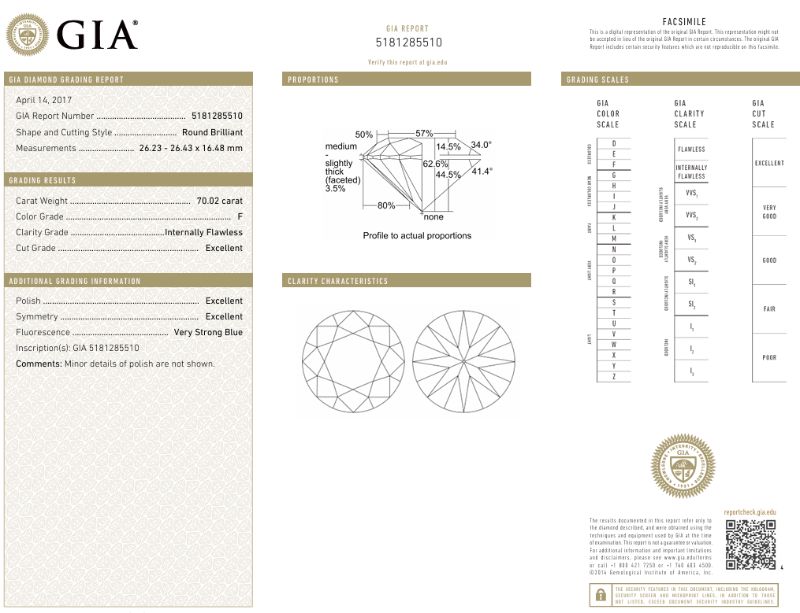

70.02 carat 5181285510

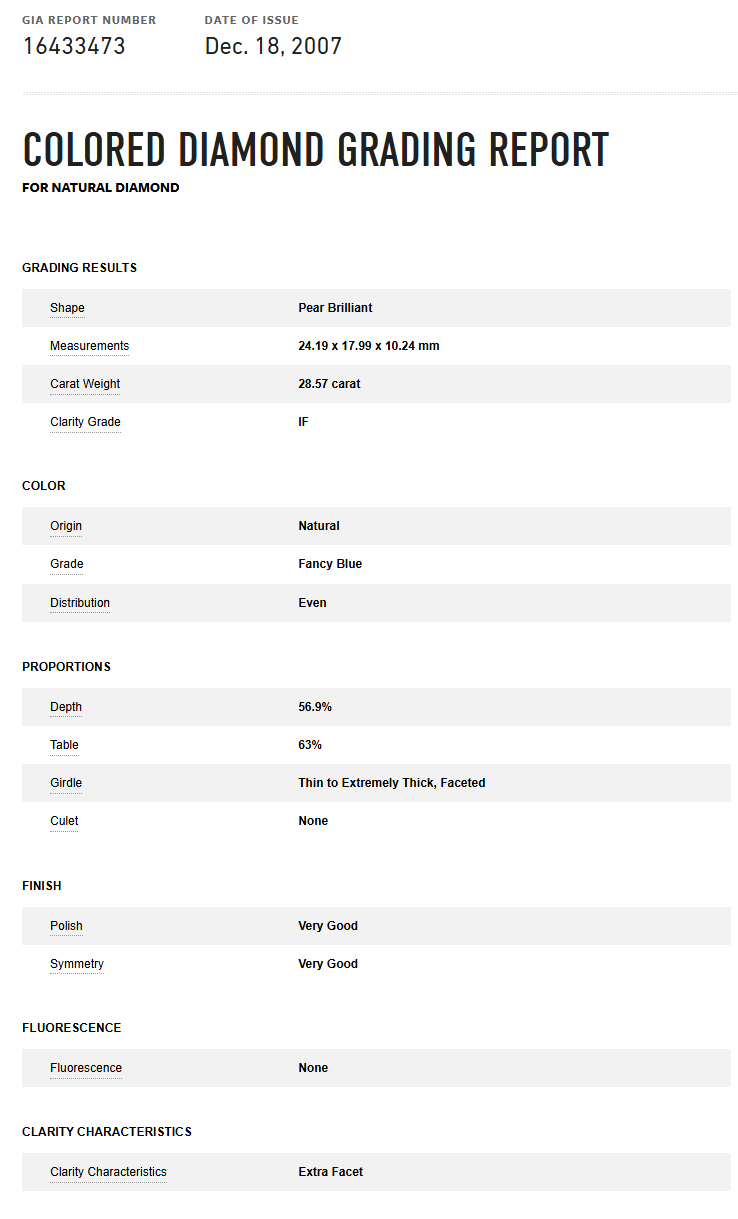

28.57 carat 16433473

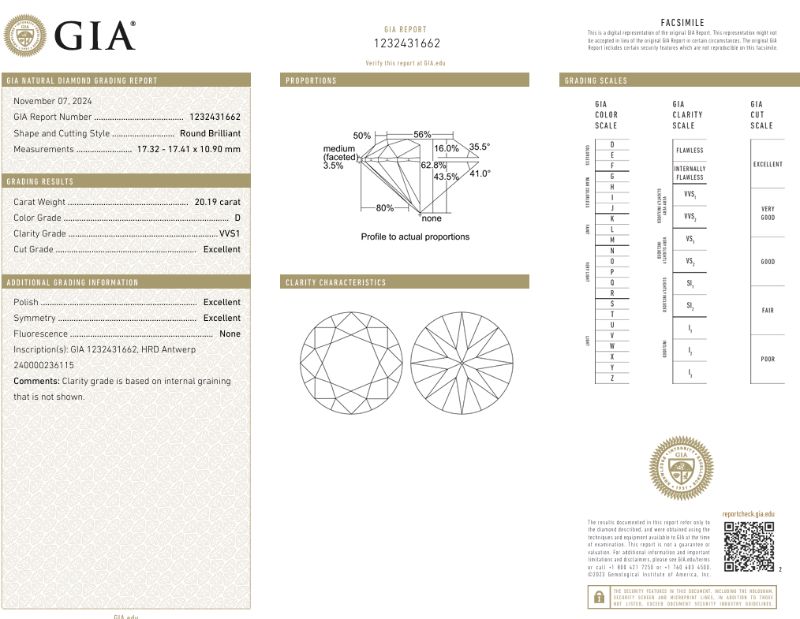

20.19 carat 1232431662

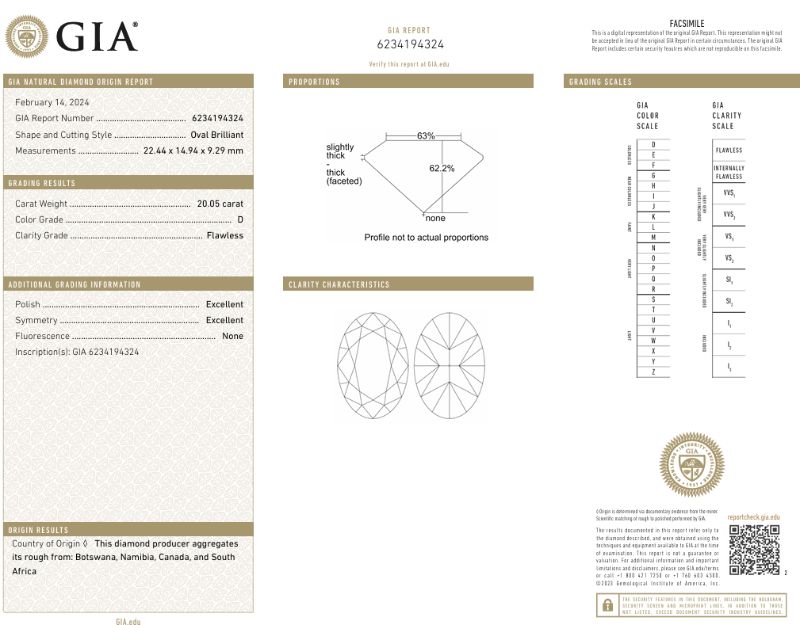

20.05 carat 6234194324

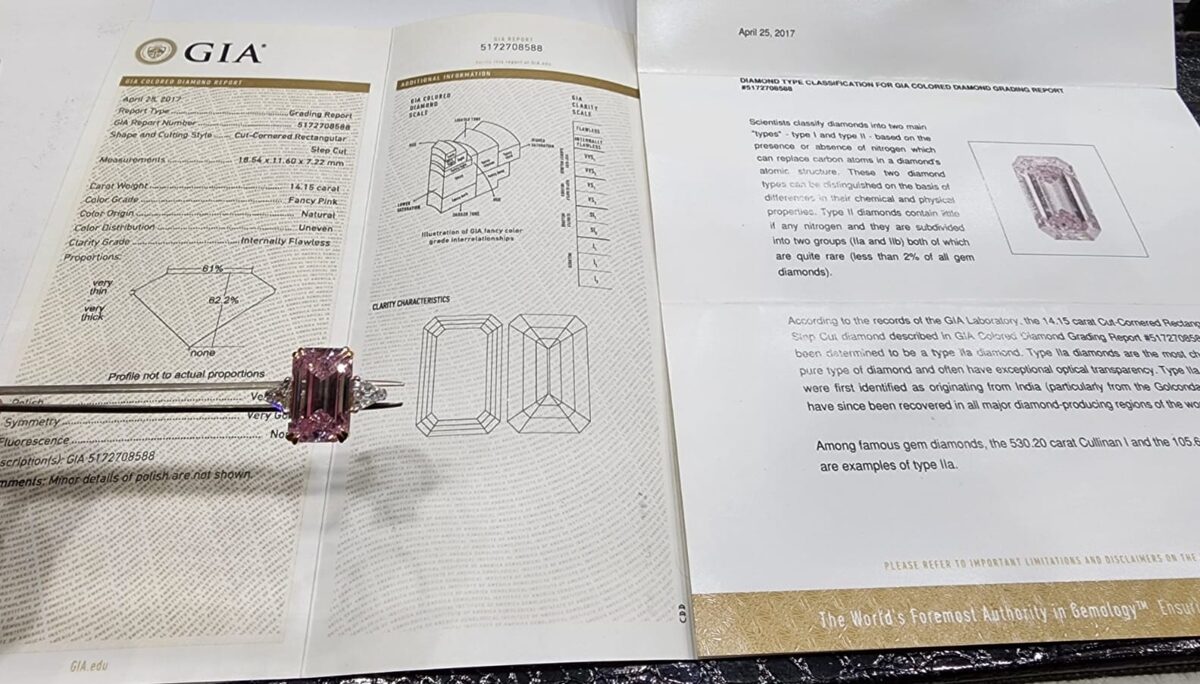

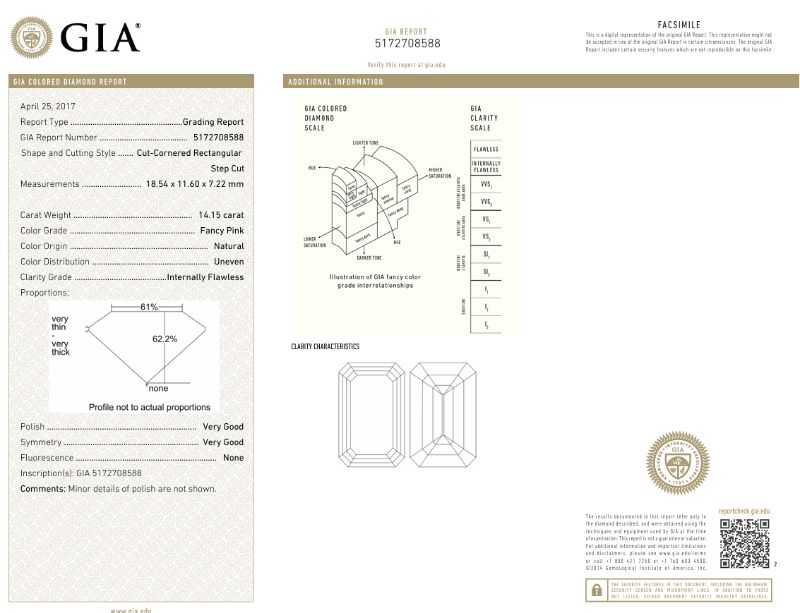

14.15 carat Fancy Pink 5172708588

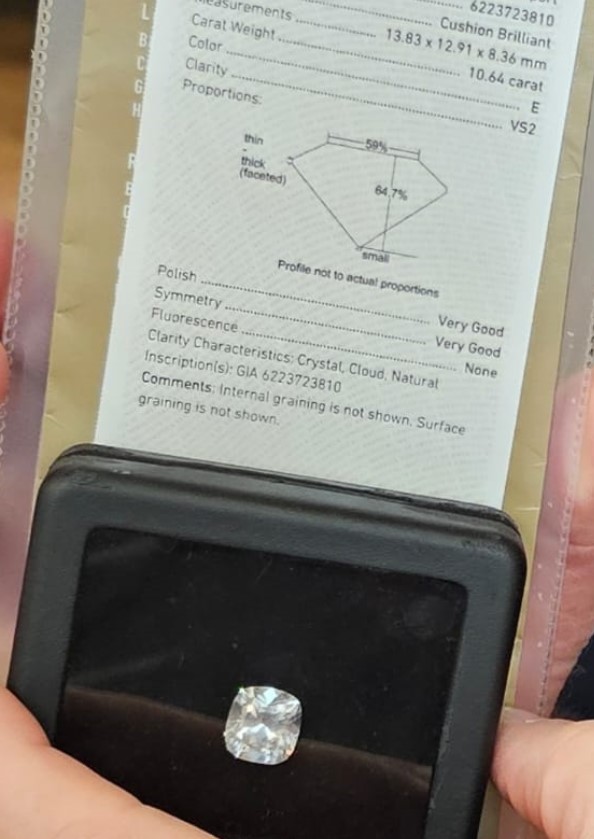

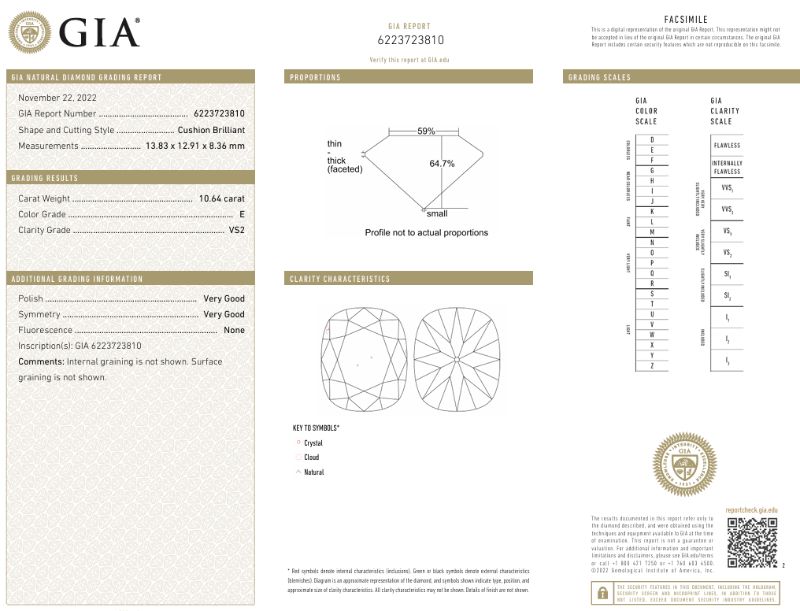

10.64 carat 6223723810

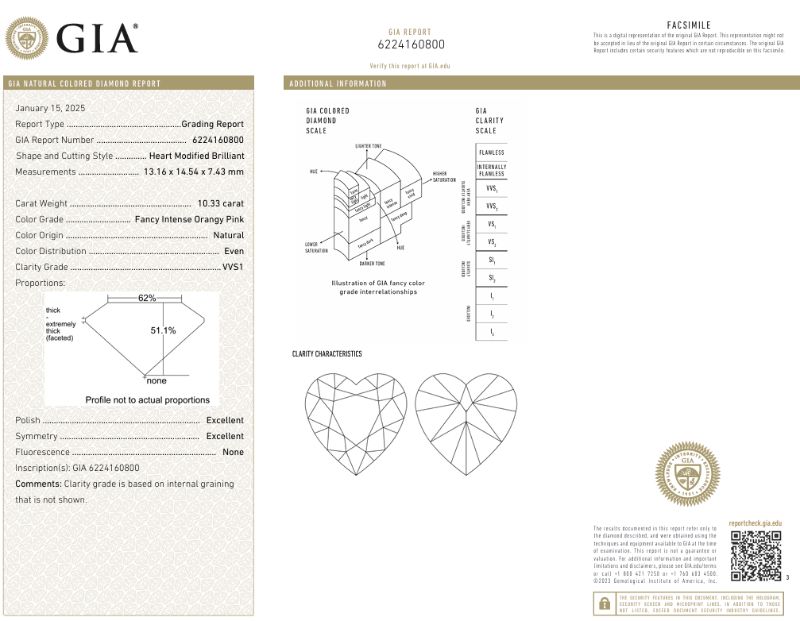

10.33 carat Fancy Intense Orangy Pink 6224160800

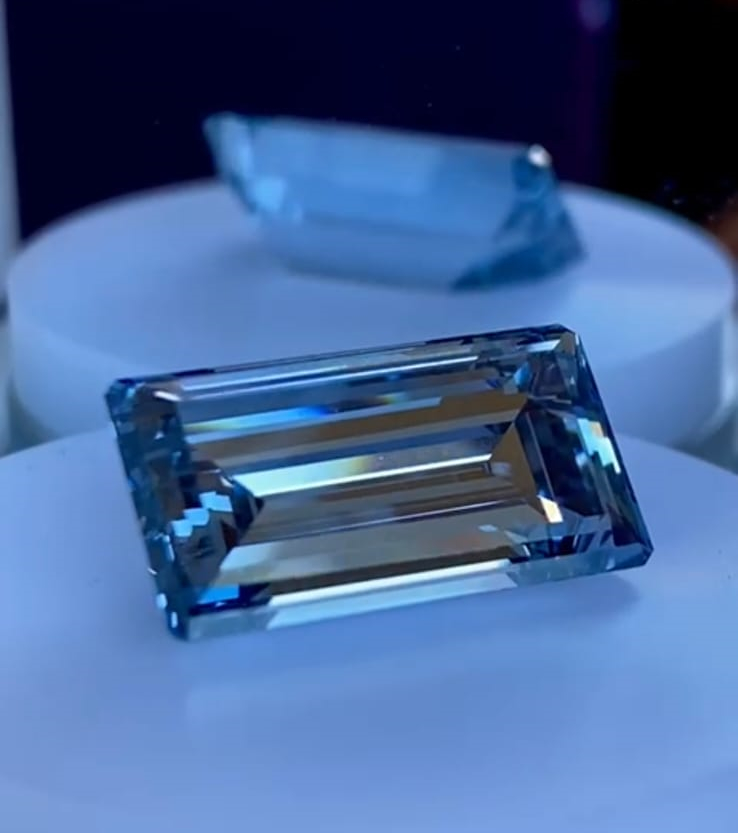

10.08 carat Fancy Vivid Blue 5191848731

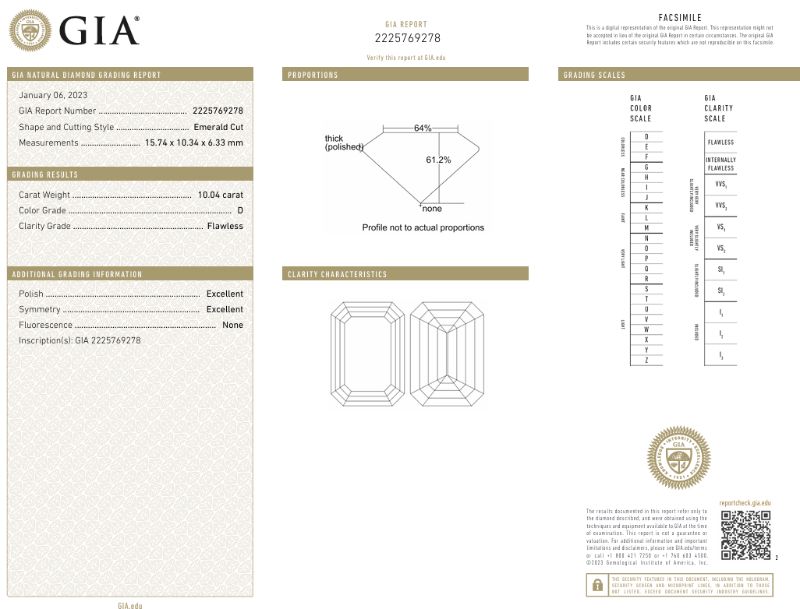

10.04 carat 2225769278

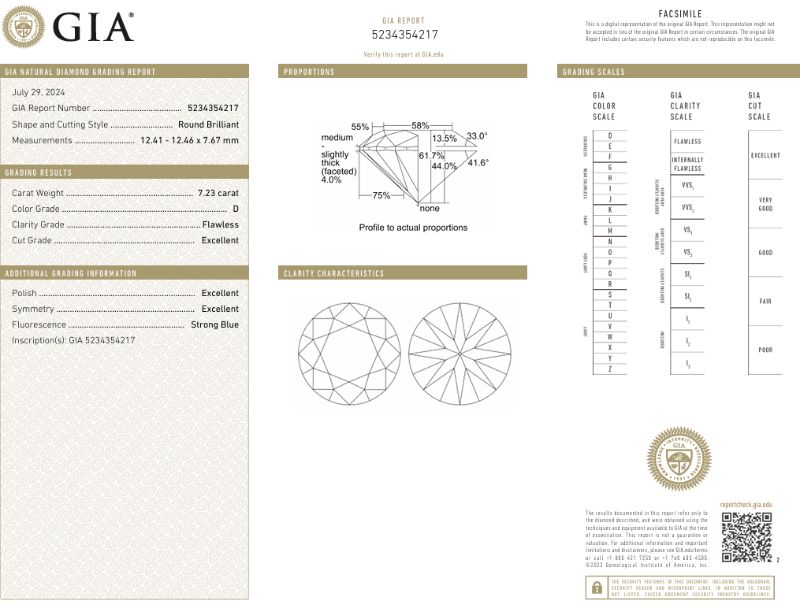

7.23 carat 5234354217

Which Diamonds Are Considered Investment-Grade?

Investment-grade diamonds are an asset gaining increasing interest among major investors. In response to this trend.

A diamond is a cut and polished version of a natural diamond – one of the rarest and most challenging minerals to extract on Earth. In 2022, the global diamond production volume, including low-quality diamonds used for industrial purposes, amounted to 118 million carats or 24 tonnes. This is 150 times less than gold and over 900 times less than silver, both of which are traditionally included in investment portfolios.

The combination of limited natural diamond reserves, the depletion of existing diamond mines, and the low probability of major new discoveries in the future, alongside increasing global demand for diamonds, creates a structural supply deficit that drives up their value. However, not all diamonds offer the same return potential.